From private practice to private equity: Five ways to navigate the shift in HCP ownership

Zachary Solomon, Creative Director, Mosaic

Consolidation and privatization have been an ongoing trend in the healthcare space. In the five years between 2018 and 2023, 423 hospital and health systems mergers were announced, and approximately 41% of physicians are affiliated with hospitals or health systems.1 As this trend has increased, healthcare has seen a similar increase in the role of private equity–investment firms that focus on purchasing companies with the goal of selling them for profit (typically within 3-7 years).2-4 Annual private equity deals grew sixfold between 2012 and 2021, from 75 to 484, and as of 2024, there were a monthly average of 87 healthcare deals.2,5 As the role of private equity continues to grow and evolve, our approach to healthcare marketing must shift accordingly.

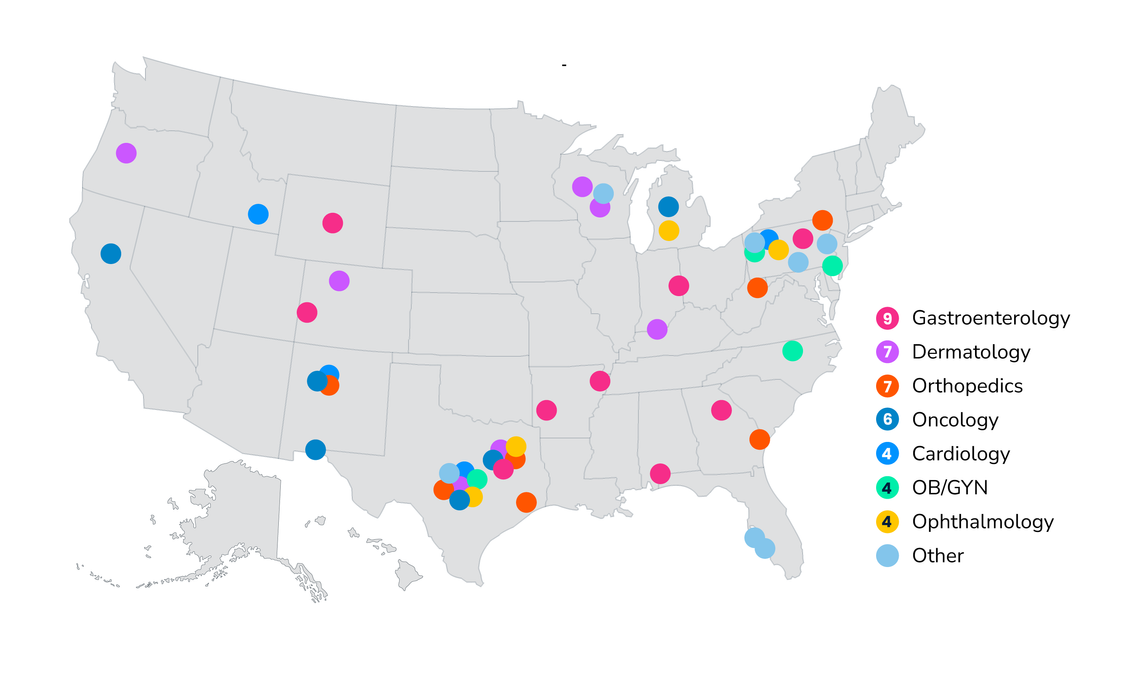

Areas of high private equity investment

Between 2022 and 2024, the American Medical Association estimates that the number of physicians employed by private equity rose from 4.4% to 6.5%. While this number may still seem small, it is centralized in distinct regions. In over 25% of metropolitan statistical areas (MSAs)*, a single private equity–backed company employs >30% of physicians, and in 13% of MSAs this number is >50%.2,6

The impact of private equity varies by physician specialty. Across reports, three specialties are consistently noted as having the largest private equity impact: dermatology, ophthalmology and gastroenterology. These specialties have been targeted based on their profitability, infrastructure needs and higher rates of fragmentation.7,8 Looking towards the future, investment in additional areas continues to grow. Key examples include urology, oncology and orthopedics.9

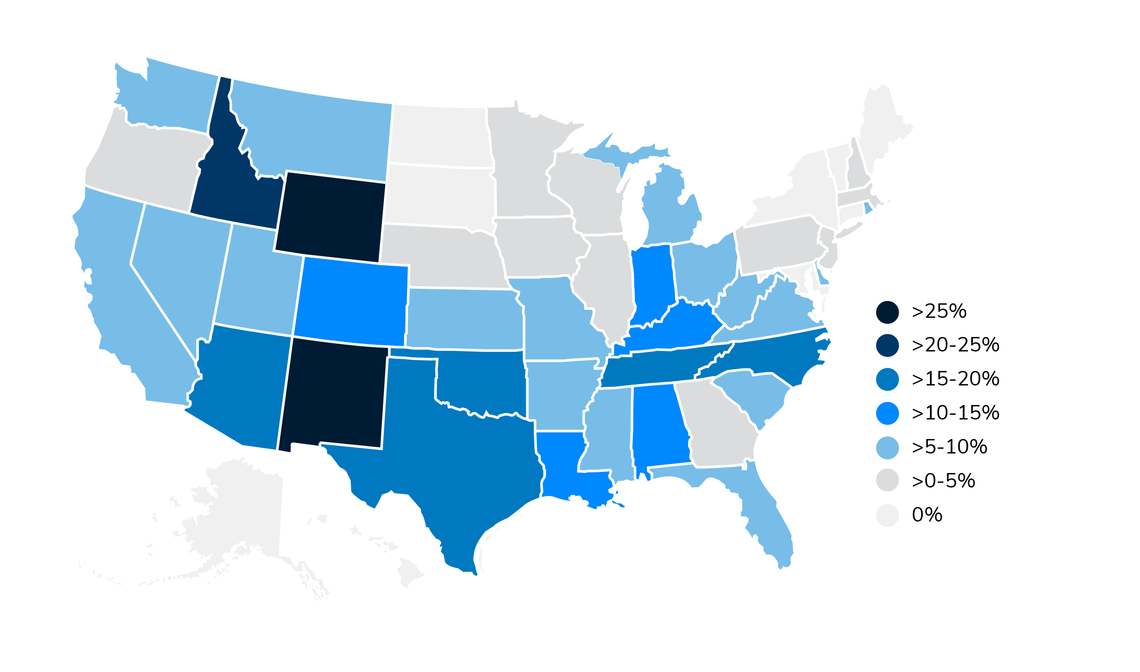

It is also important to highlight the increasing investment of private equity in key sites of care (listed below).10-14 Ownership of hospitals similarly varies across the country, with the largest presence seen in New Mexico and Wyoming.14

Healthcare sectors with high private equity activity:

Specialties

- Dermatology

- Opthamology

- Gastroenterology

- Urology

- Oncology

- Orthopedics

Sites of care

- Hospitals

- Behavioral health facilities

- Ambulatory surgical centers

- Elder care

- Infusion centers

*MSAs represent a county or a group of counties with at least one urbanized area with a population ≥50,000.

MSAs with >50% private equity ownership of one or more HCP specialties in 20212

Private equity ownership of hospitals by state14

What private equity means for healthcare marketers

This increased role of private equity has led to growing concerns about the impact on overall patient care and costs, as the ultimate goal of private equity is to resell the practice/site of care for a profit. Private equity-backed hospitals have been associated with lower Medicare star ratings, increased hospital-acquired patient adverse events, reductions in staffing and shifts in patient population (e.g., an increase in affluent, privately insured patients relative to those covered by Medicare or Medicaid).2,4,14-16 As the makeup of the healthcare system continues to evolve with the growth of private equity, it’s critical that healthcare marketers think through the nuanced impact of this shift.

Key impacts and what it means for healthcare marketing:

1. Increased focus on profitability17,18: Private equity ownership is often associated with an increased focus on profitability, especially in theshort term.

Value-based conversations need to take this shift into account, which may mean needing to adjust the value equation to prioritize nearer-term benefits. This may require customized value communications or more nuanced discussions by field teams.

2. Conversion of HCPs into owners19: In practices and facilities that are private equityowned, the conversion of HCPs into partial owners increases their role as a financial decision-maker of the organization.

As marketers, we will need to address the growing role of the HCP as a financial decision-maker, which may necessitate strong partnership between market access teams and direct-to-professional marketing in order to ensure communications best address the multifaceted needs of customers.

3. Increased patient costs2- 10: The increased focus on costs associated with private equity can also lead to an increase in out-of-pocket costs, as patients may face higher co-insurance costs and be at higher risk for surprise medical billing.

Patient affordability programs and education are both critical to help minimize the burden on patients and their caregivers. Additionally, case managers and patient support programs can help patients understand the shift in expenses and the available services to address the cost increase.

4. Shift in care to the private market4,16: Private-equity acquisition has also been associated with a shift of patient mix towards private insurers (away from Medicare FFS). Especially in categories with higher Medicare prevalence, this shift may lead to gaps in access to care.

Patients in regions with high private equity presence may need additional support in finding providers or sites of care to ensure they receive the care they need. Patient support services can help fill this role, especially for categories/treatments with limited available providers.

5. Variability by MSA/Specialty 2,6:As noted above, the impact of private equity varies significantly across the country.

Sales and account management teams may need more nuanced support in areas of higher private equity prevalence. This may require specialized training on the nuances of private equity marketing, including necessary shifts to the overall brand value story.

Takeaway

As the role of private equity continues to grow, it is critical we evolve our approach and thinking to healthcare marketing. We continue to monitor these trends – and the state-specific and federal regulatory changes associated with private equity – to help manufacturers understand how to nuance communications and ensure all customers understand the value of their products and services.

References

1 Ten things to know about consolidation in health care provider markets

2 Monetizing medicine: private equity and competition in physician practice markets

3 Private equity in health care: a state-based policy perspective

5 Private equity healthcare deals: 2024 in review

6 HHS consolidation in health care markets RFI response

7 Why PE firms are investing in specialty healthcare practices

8 Evolution of healthcare private equity – what’s next for independent practices?

9 Private equity’s medical practice consolidation curve: where different specialties lie

10 Private equity investment in surgical care

11 Private equity is continuing to acquire and bankrupt nursing homes

12 Private equity active in the infusion services market: 6 deals

13 Private equity owns 25% of mental health facilities in some states

14 PSEP private equity hospital tracker

15 The battle for ASC ownership

16 Changes in hospital income, use, and quality associated with private equity acquisition

17 Private equity in ASCs: a double-edged sword for independence and growth

18 Private equity and healthcare firm behavior: evidence from ambulatory surgery centers

19 Spillover effects from private equity acquisitions in the health care sector